The EUR/USD currency pair moved very calmly on Monday. We admit that we expected a noticeable correction on the first trading day of the week and throughout the week, but so far, our calculations have yet to be justified. So far, there is a clear upward trend for the euro/dollar pair, and, from a technical point of view, everything now speaks in favor of further growth of the euro currency. Recall that on the 24-hour TF, the price managed to overcome all the important lines of the Ichimoku indicator, so finally, we can witness a reversal of the long-term downward trend. At the same time, the "foundation" and geopolitics can break the entire "raspberry" of the European currency at any moment. After all, it is not the euro that is growing but the dollar that is falling. Let's read more: the dollar has been growing for almost two years, and traders have been busy buying American currency. And now they are reducing purchases, reducing the demand for the dollar, so the pair is growing, but this does not mean that the demand for the euro currency is growing.

If we talk about the demand for a particular currency, it is best to turn to COT reports. However, they do not give a clear answer to what is happening in the minds of traders and investors. The net position on the euro among professional traders has long been "bullish," and the euro currency began to grow only in the last couple of weeks. Moreover, according to the logic of things, this "bullish" position should increase for the European currency to continue growing. Or it should decline against the US dollar. As we can see, there are certain reasons for the pair's growth in the future, but they still need to look more convincing as the factors for the growth of the US dollar at the beginning or middle of this year. We rely on technical analysis when we make forecasts and recommendations, so now we need to look more toward purchases. But at the same time, we must keep in mind that the current growth of the euro is quite doubtful from a fundamental background point of view.

The EU inflation report will be quite formal.

The current week began with the publication of a report on industrial production in the EU. It turned out to be slightly better than predicted, which could support the euro on Monday. However, this is different from the scale of inflation or central bank meetings, so count on a long and strong market reaction. Let's go through the other events of the week in Europe.

The second estimate of the GDP report for the third quarter will be published today. The market is waiting for a slowdown in the growth rate of the European economy to 0.2% q/q. Still, in principle, all indicator estimates do not have much significance for the market. Some reactions may follow this report, but it is too "stretched" in time to "see" a reaction to it. Recall that three estimates are always published for GDP, which rarely differs much from each other. And in any case, the market is more interested in the ECB's monetary policy, which directly impacts GDP.

Thus, a much more important event will be the speech of ECB President Christine Lagarde on Wednesday. The ECB seems to have decided to raise the rate "to the bitter end" or at least "significantly" to lower inflation in the Eurozone as much as possible. This is good news for the euro, but the market needs to understand to what level the regulator will be ready to raise the key rate. We have already said earlier that not all member countries of the alliance can bear the high cost of borrowing relatively smoothly for their economies. The ECB should consider the interests of all EU members, so the rate will not rise to 5%, as, for example, in the USA.

Christine Lagarde can refute this assumption or confirm it. She may want to do this, but her comments may dissuade traders from continuing to buy the euro currency (if they even have a place to be). So far, the euro is growing more on the fact that the Fed will stop raising its rate in a few months, and since traders had plenty of time to work out all the tightening of monetary policy, now the actions of the ECB, which is behind schedule from the Fed, are more important.

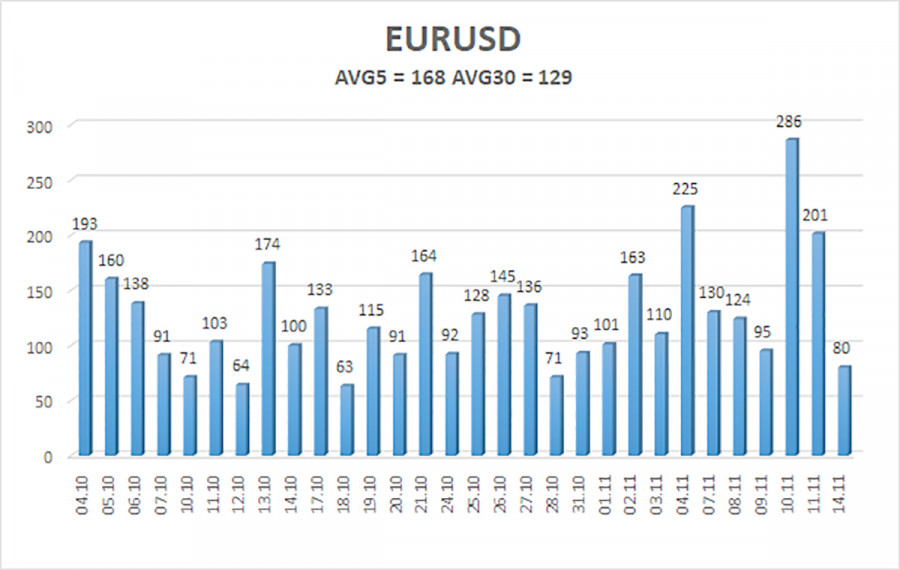

The average volatility of the euro/dollar currency pair over the last five trading days as of November 15 is 168 points and is characterized as "high." Thus, we expect the pair to move between 1.0177 and 1.0513 on Tuesday. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.0254

S2 – 1.0132

S3 – 1.0010

Nearest resistance levels:

R1 – 1.0376

R2 – 1.0498

R3 – 1.0620

Trading Recommendations:

The EUR/USD pair continues to move north. Thus, we should stay in long positions with targets of 1.0498 and 1.0513 until the Heiken Ashi indicator turns down. Sales will become relevant again by fixing the price below the moving average line with targets of 1.0010 and 0.9888.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.