The struggle continues for the EUR/USD pair: the bulls need to settle in the area of the 4th figure to show the strength of the upward movement, whereas the bears need to settle near the 2nd price level to finally stop the upward momentum and pave the way for the next surge to the parity level. Both sides of the "conflict", in fact, do not need a third figure, which in the current circumstances acts as a point of transit.

Take note that both bears and bulls of the pair can boast of their momentary successes, but in reality they failed to consolidate their gains. The contradictory fundamental background is to blame.

At the beginning of November, the dollar weakened across the market due to several factors. U.S. inflation slowed its growth, Federal Reserve officials admitted the possibility of a slowdown in monetary policy tightening, and the results of the G20 summit set the warmer tone for U.S.-China relations. All these factors came together to boost interest in risky assets, while the safe-haven dollar was out of action. The euro surged, reaching 1.0480.

Then, the news flow changed a bit. The US central bank represented by many of its Committee members (Bullard, Cook, Daley, Waller and others) claims that slowing down the pace of interest rate hikes does not negate the fact that the upper bar of the current cycle may be reviewed upwards. By the way, Fed Chairman Jerome Powell also spoke about this scenario after the November meeting.

The focus of the market attention shifted, the hawkish expectations strengthened and the dollar was back on the horse, due to which the pair fell to 1.0225.

But bears couldn't settle in this price area. The dollar was under pressure again due to a new report, thereby, allowing the euro bulls to organize one more counterattack.

We are talking about the minutes of the Fed's last meeting, which was published on Wednesday. In my opinion this document was not dovish at all. Moreover, all the key theses of the minutes were played back by the market - this report didn't bring anything sensational.

But the fact is that traders reflexively reacted to the facts that have already been regarded, which were presented to the market in a "new cover". The essence of the minutes boils down to one simple conclusion: Fed members are ready to move further by smaller steps, i.e. more moderate rates. The document states that a number of Committee members believe that "a rapid tightening of monetary policy could pose a threat to economic growth and financial stability.

Given the fact that the November FOMC meeting took place even before the release of data on October inflation growth in the U.S., we can assume that the central bank will slow down the pace of rate hikes at the next (December) meeting. That is, after four increases of 75 basis points, the central bank will raise the rate by 50 points.

The minutes only confirmed the assumptions discussed earlier, putting a thick end to the relevant discussion. But the minutes did not answer the main question: how high can the final rate climb? The fact that the Fed will slow the rate hike is no indication that the upper bar of the current cycle will be lowered. In fact, some Fed officials (notably James Bullard) recently said that the "final stop" would probably be at 5.25%.

Incidentally, in the same minutes, Fed members indicated that there has been "clear but little apparent progress" on inflation, and that rates still need to be raised.

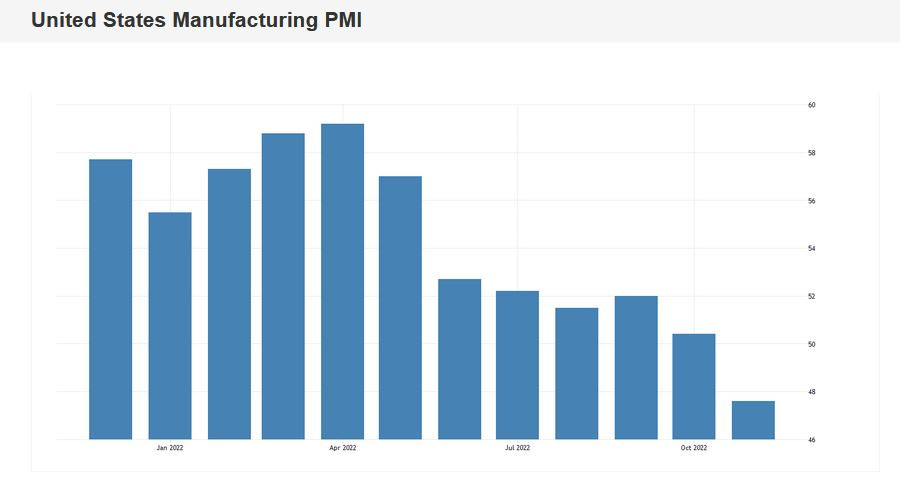

Therefore, in my opinion, the EUR/USD pair is growing on rather shaky grounds. Again, the bulls were supported by a trivial coincidence: The Fed's minutes were published ahead of Thanksgiving in America, amid low liquidity and high volatility. US statistics also weighed on the greenback: according to the latest data, business activity in the US declined again in November - both in the service sector and manufacturing. At the same time, the new orders dropped to the lowest level in 2.5 years.

And yet long positions on the pair look risky. In fact, bulls have already played their game - there are no good reasons to develop an uptrend. Only the shortened Friday session (due to Thanksgiving) is on their side, due to which an inertial price growth is possible.

Several factors are in favor of the bearish scenario. Firstly, the European Central Bank is also getting ready to slow down the pace of interest rate hikes in December. This was stated by some ECB officials over the past two weeks (in particular, Philip Lane and Mario Centeno), as evidenced by the minutes of the ECB's last meeting, which was published on Thursday. According to the document, back in October several members of the Governing Council were in favor of raising the rate by 50 basis points, not 75.

Secondly, the safe-haven dollar (and consequently the EUR/USD bears) may find support from the news from China, where the number of coronavirus infections is growing. For example, on Wednesday the number of infections in China exceeded the 30,000th mark. Chinese authorities are once again forced to tighten quarantine measures, with partial lockdowns and mass testing resumed in major cities. The "zero-tolerance" policy, which has cost the Chinese (and global) economy so dearly, is back on track after easing the Covid policy.

Thus, in my opinion, short positions in the pair look more promising, despite the contradictory fundamental background. The first bearish target is 1.0350 (the line Tenkan-sen on the D1 timeframe). The next (and so far the main) target is 1.0210. At this price point the bottom of the Bollinger Bands indicator coincides with the lower limit of the Kumo cloud on the four-hour chart.