Monday will undoubtedly go down in history as a day of skyrocketing fear of the biggest banking crisis in history.

Measures taken by the US Treasury, the Federal Reserve and the Federal Deposit Insurance Corporation, aimed at curbing the banking crisis, brought the first results, the fall in UST yields stopped, and the threat of avalanche withdrawal by depositors became significantly lower. However, many banks in their analytical reviews note that the measures taken will not be enough to fully contain the development of panic.

Goldman Sachs was the first bank to announce that the Fed would not raise rates at its March 22 meeting. Rate futures are now seeing a +13p increase, compared to +33p at the week's close on Friday and +43p after Fed Chairman Jerome Powell's speech to Congress. The first rate cut has been moved from January 2024 to June 2023, with a year-end forecast of 3.785%, almost 100 points lower than last week.

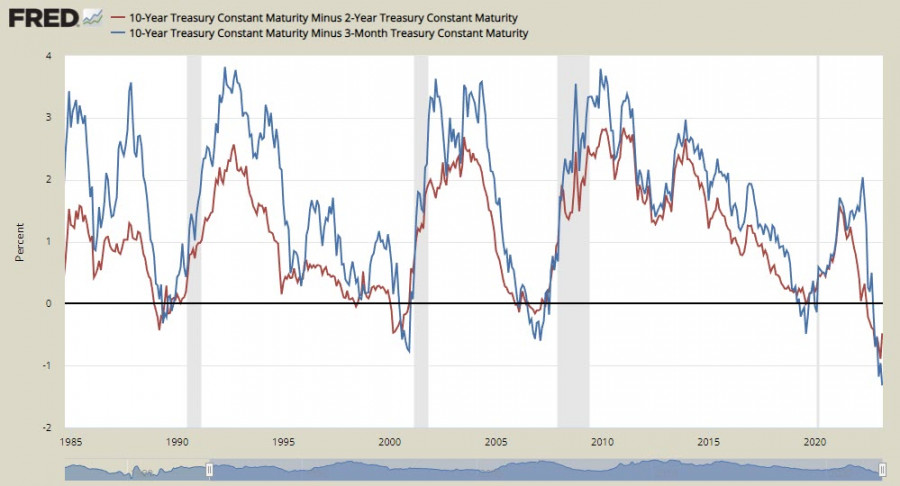

The yield curves between the 10-year UST and the faster 2-year and 3-month UST foreshadow an inevitable recession in the coming months.

It should also be noted that rate hikes by central banks were a response to rising inflation. Recent measures, however, which have led to a drop in peak rate expectations, as well as a weaker U.S. dollar, are inflationary in nature, meaning that fighting inflation now looks significantly more challenging.

Consumer inflation rose 0.4% in February, overall growth was 6% y/y, core inflation was 5.5% y/y, all in line with forecasts and unlikely to have any impact on the outcome of the FOMC meeting on March 22.

Overall we could say that the markets have stabilized, but we don't know how long it will last. Risk appetite is returning and the flight to defensive assets has slowed. Markets will be assessing the depth and implications of the banking crisis which will take more time and more data. The outlook for the FOMC meeting so far is in favor of an increase, because if the FOMC rejects an increase next week, it will be a very negative signal for the markets, which could trigger another wave of panic.

NZDUSD

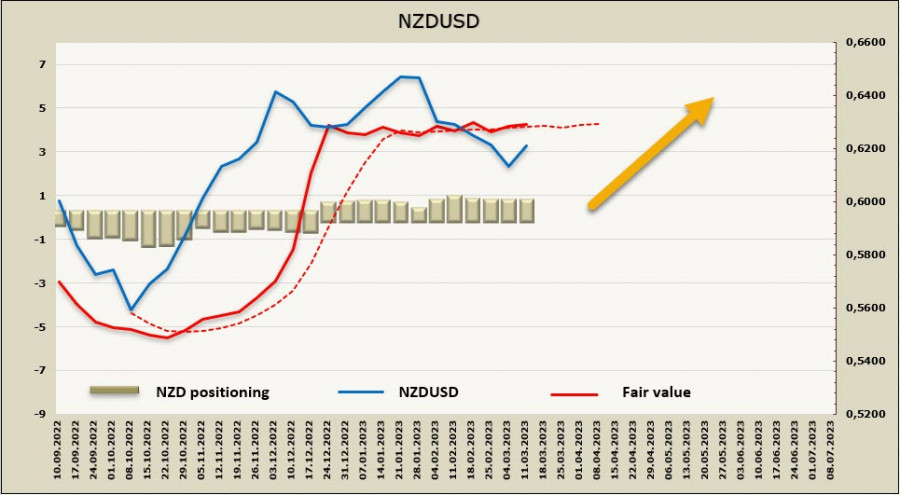

The NZD suddenly performed the best among the G10 currencies amid a rapidly developing panic. The strong link between the kiwi and risk appetite has clearly been broken in the last two trading sessions, and this has yet to be explained.

The turmoil has also caused a reassessment of the RBNZ rate expectations, but so far not very noticeable - the markets see the April rate hike at 33p and the rate peak at 5.4%, which is not much lower than the previous week's peaks. This is a good result and it plays in favor of the NZD even taking into account the problems in the housing sector and the fact that the New Zealand economy is on the verge of recession.

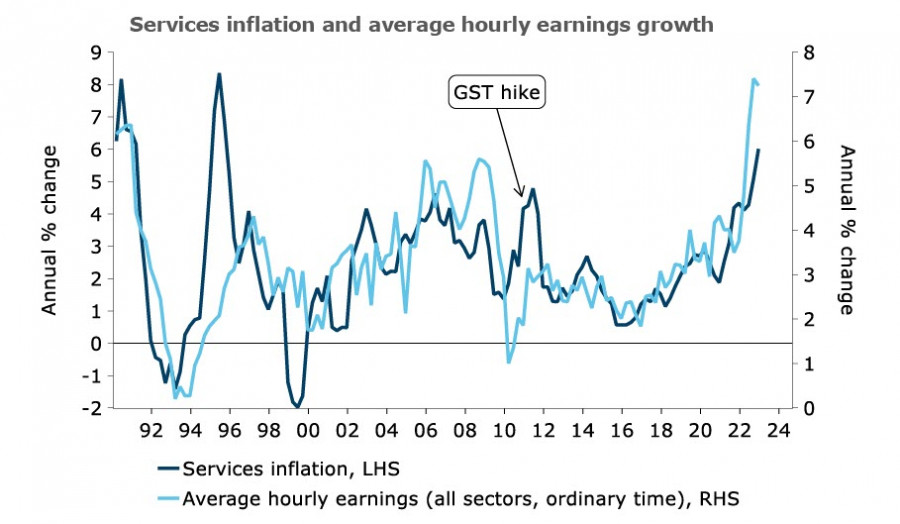

The ANZ Bank notes in its survey that inflationary pressures are starting to shift from the commodity group to the service sector, which in turn is more resilient and closely linked to the labor market - the higher the rate of wage growth, the higher inflation.

Accordingly, even assuming that if annual commodity inflation returns to normal levels, overall inflation will be stuck well above target levels. If, under these conditions, the banking crisis becomes widespread and measures to deal with it develop, the threat of stagflation will become substantially greater.

Speculative positioning on NZD remains moderately bullish, the settlement price, despite the shocks of the last days, stays above the long-term average, chances that it will continue to increase look strong enough.

A week earlier, guided by Powell's hawkish report to Congress, we expected the NZDUSD to drift further to the downside as Fed rate expectations strengthened towards a stronger tightening. The last few days have turned things around, and now the dollar's chances of dominance have diminished significantly. The recent low at 0.6079 is likely to be the long term support, we expect sideways trading and an uptrend, the nearest target is 0.6271, closing above that level will open the way to 0.6360/80.

AUDUSD

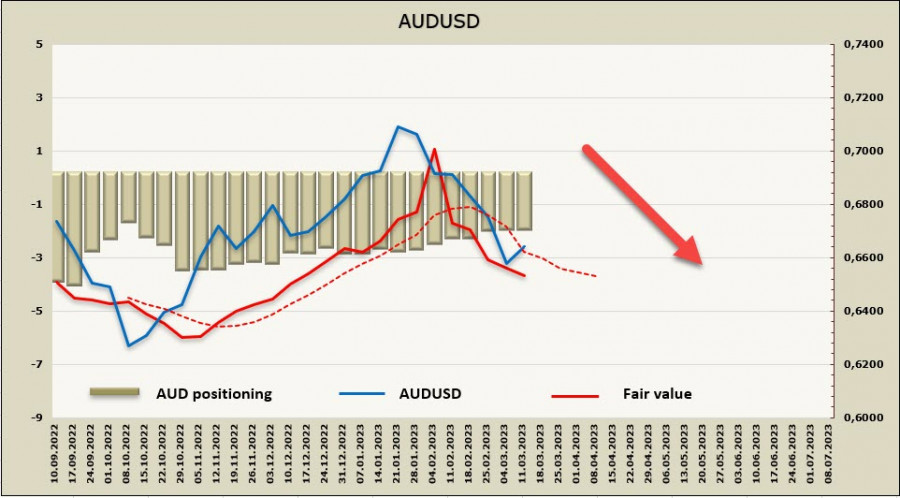

The National Australia Bank business confidence index declined in February from 6p to -4p, conditions index from 18 to 17p, both indexes were worse than expected. Overall, the NAB report confirms the stability of the economy but raises concerns about the acceleration of wage growth from 2.1% to 2.8% q/q, reflecting unrelenting inflationary pressures.

Several important macro data will be released on Thursday, notably inflation expectations and the February labor market report, after which the Reserve Bank of Australia's rate expectations may undergo an adjustment.

The AUD looks noticeably weaker than the NZD, with the settlement price continuing to move steadily to the downside.

AUDUSD growth on the background of incoming news from the US will find resistance in the 0.6780/90 area, where short positions, most likely, will resume. A logical tactic seems to be selling on attempts at growth, I expect a test of the support zone at 0.6570/85 and consolidation below this area.