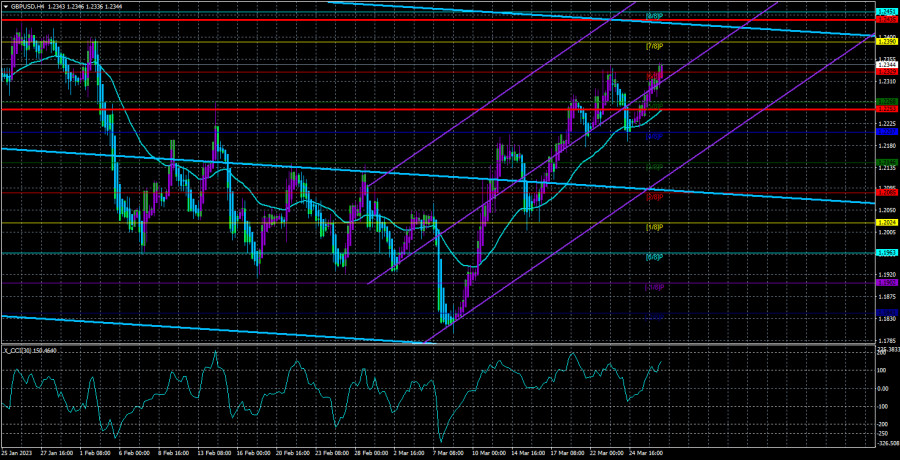

The GBP/USD currency pair continued its slight upward movement on Tuesday, having earlier bounced off the moving average line. Therefore, from a technical standpoint, we have every justification for continuing to support the pound. Remember that the side channel 1.1840–1.2440 on the 24-hour TF is still active, allowing the pound to rise as high as it can without the necessary fundamental and macroeconomic backdrop. Another 100-150 points are added to this. Another point is that the pound has already increased by 500 points since its previous local low, whereas it had previously been in a prolonged period of typical "swings." It is still very challenging to comprehend why the dollar has dropped so sharply when you view the situation through the lens of fundamental analysis.

However, let us not fantasize about betting again. How much longer will the pound increase even if the market now genuinely thinks that the UK will tighten its monetary policy more than the US? We advise beginning your trading choices with technical analysis for the time being. As you can see, there weren't many noteworthy events on Monday and Tuesday, but despite that, the pound still finds the fortitude to move north after increasing by 500 points. Also, take note of the pound's recent excessive growth. Although the Bank of England has slowed the pace of tightening to a minimum, the pound's recent excessive growth signals the end of the tightening monetary policy cycle, just as it has in the US. Although the regulator does not anticipate the rate to reach 2008 levels, Andrew Bailey stated on Monday and Tuesday that it will increase for a while. The rate is currently 4.25%, which suggests a limit of multiple increases of 0.25%. The Fed can demonstrate the same outcome. Additionally, this outcome falls short of the 2.9% inflation target Andrew Bailey mentioned a week earlier for the year's conclusion.

The Fed has "reached the finish line," according to experts.

RBC Economics has also commented on Fed interest rates. The regulator "has reached the peak of the key rate, and only one tightening will take place in the future," the newspaper claims. Although, as we previously stated, we anticipate a stronger recovery, it is obvious that traders are considering these messages when reducing demand for the dollar. It appears that the subject at hand is not even how much the Fed rate will increase, but rather what kind of basic background different banks, media outlets, and analytical organizations will form on it. What can market players do if everyone claims that the rate won't increase once more?

The Fed has finished its cycle of tightening, according to KPMG Chief Economist Diana Swank, who also referred to the Fed's most recent rate increase in March as "dovish." She added that the Fed might cancel the QT program to avoid putting more strain on the economy, whose risks of a downturn have lately risen as a result of the banking crisis. According to her, the Fed is worried that the rate has risen by almost 5% in just one year and that the economy may "stall" rather than just "slow down a little." Another viewpoint that causes the greenback to be sold.

Rafael Bostic, the president of the Atlanta Fed, stated on Friday that it was "difficult" to decide whether to raise interest rates in March, which added credibility to the general tendency. He seemed to indicate that the Fed already has doubts about the necessity of increasing the rate and spends considerable time discussing this at each meeting. Even though he reaffirmed that the Fed's primary objective is still "taking control of inflation," doing so will be very challenging if the rate stops increasing. The basic background that exists today, in our opinion, is strange and does not reflect the actual situation. As a result, we are seeing the market respond to what is happening in a way that is not completely logical. We can expect growth with a target of 1.2440 as long as the price is above the moving average, but the key will be whether or not the pair exits the side channel on the 24-hour TF.

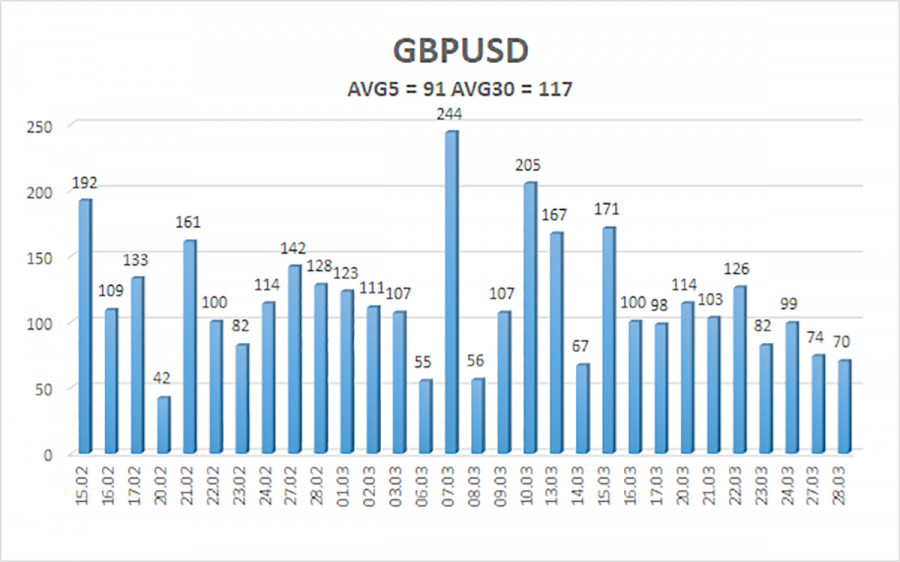

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 91 points. This value is "average" for the dollar/pound exchange rate. Thus, on March 29, we anticipate movement that is contained within the channel and is limited by the values of 1.2253 and 1.2435. A new round of corrective movement will begin when the Heiken Ashi indicator reverses direction and moves back down.

Nearest levels of support

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest levels of resistance

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading Suggestions:

In a 4-hour time frame, the GBP/USD pair is trying to maintain the upward trend. Until the Heiken Ashi indicator goes down, you can continue holding long positions with targets of 1.2390 and 1.2435. If the price is set below the moving average with targets of 1.2207 and 1.2146, short positions may be taken into account.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.