Would you like to try automated trading but don't know where to begin? In this article, you will find our step-by-step instructions for a successful start.

By following our recommendations, you will be able to do automated trading without any trouble.

If you want to learn more about all the features, advantages, and disadvantages of automated trading, read the article "Automated forex trading using programs and robots".

5 steps to getting started with auto trading software

In the ads, trading with the help of robots is often presented as something that does not require any effort from users. This is not entirely true.

Let's discuss the steps that traders need to make if they want to use automated trading efficiently and reap profit.

1. Learn the basics of trading. There are lots of opportunities to do so: training courses, paid and free webinars where trades can get more or less deep knowledge of the subject. Choose the most convenient training format for you and get started.

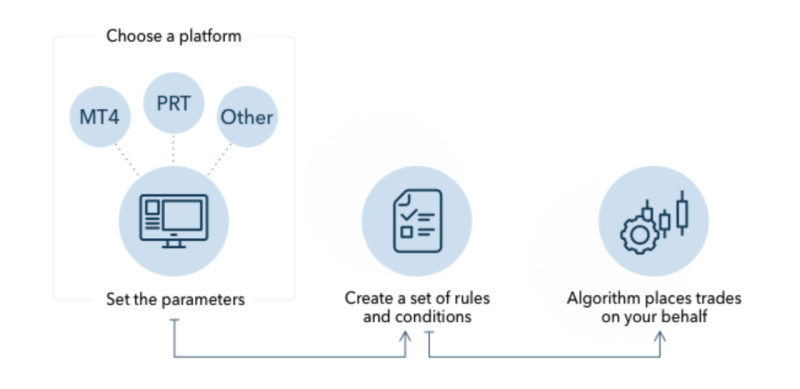

2. Choose a trading platform and broker. Trading platforms differ from each other in terms of usability, built-in functions, and other parameters. Find the one that will best suit you. When it comes to choosing a broker, you should consider all the options rather seriously. We will talk about the criteria for finding a reliable brokerage company later.

3. Develop your own trading strategy or choose from existing ones. Traders have already developed numerous trading strategies. However, it will also be great if you create something new.

4. Choose the trading bot that suits your trading strategy the most. From a huge variety of expert advisors, you will definitely be able to pick the one that is right for you. If you cannot find anything, you can develop a bot by yourself or order it from programmers.

5. Study all the nuances of the robot, configure it, and start trading. For successful trading, you need to clearly understand how the Expert Advisor works and constantly monitor its work. If the bot does work properly due to some technical failure or something else, it is necessary to optimize it.

6. Remember that there is no such trading strategy that would suit everyone. The same applies to trading robots.

7. Therefore, traders choose the strategy and the trading according to their own purposes. This is why there is such a great array of EAs.

Trading platforms and brokers allowing automated trading

Before you start trading, you need to choose a suitable trading platform as well as a brokerage company.

Notably, not all trading platforms allow auto trading software. The most popular platforms that support trading robots are:

- MetaTrader 4 is a widely popular trading platform among traders. Many trading robots and technical indicators are available in the MetaTrader 4 Market. You can buy or download a free EA. In addition, the platform enables users to create robots themselves or find a developer that will create a robot according to their needs. The platform also provides an opportunity to test trading strategies and Expert Advisors.

- MetaTrader 5. The main difference between this platform and its predecessor is that it gives access to other instruments apart from currency pairs. The programming language is simpler than in MT4. There are more opportunities for testing. Other functions are similar to the MetaTrader 4 platform.

- On the cTrader platform, there is a cBots section where you can select, download, test, and optimize trading bots. The platform also allows you to create your own Expert Advisors.

- When using the NinjaTrader platform, you can find the NinjaScripts section. It enables users to develop trading robots. The platform also makes it possible to create and implement strategies for automated trading, using trading signals from third-party apps. There is also an opportunity to apply features for your automated trading from third-party apps.

Some trading platforms offer an alternative to auto trading software – social trading. It includes such trading options as Copy Trading, the PAMM service, and others.

The main difference between social trading and automated one is that in the first case, real people trade, and in the second case, special computer programs do your work.

Not all brokers allow automated trading. You should keep it in mind when choosing a broker.

Pay attention to these features too when choosing a brokerage company:

- working experience and reliability of a broker;

- narrow spreads;

- high speed of order execution;

- license;

- support team;

- available account types and minimum deposit amount;

- access to markets.

Fully automated and semi-automated bots

Trading robots are divided into two large categories: automated and semi-automated. Let's discuss these categories in more detail.

Semi-automated bots are also called Expert Advisors as they can help you automate your trading strategies. Yet, these robots do not make transactions.

Their main task is to analyze market movements according to the parameters set in their algorithm and find the best moment to open or close positions. They just give a signal while traders make the final decision.

Unlike semi-automated Expert Advisors, automated robots are able to analyze the market and make transactions.

Experienced traders believe that you can fully rely on automated bots if they are designed precisely for your trading strategy.

However, due to the fact that robots do not have intuition and cannot predict the impact of fundamental factors on the market, they are unable to respond promptly to sudden changes.

Therefore, regardless of whether you use automated or semi-automated robots, we recommend that you constantly monitor their work. If necessary, you can intervene and change the settings of the bot.

Semi-automated trading may seem rather inconvenient, especially if speculators have positions on several instruments at once.

You can also receive several signals from expert advisors simultaneously. If so, you may not have time to manually make several trades at the same time and thus miss part of the profit.

When speculators heavily rely on a trading bot giving it full command of trades, they risk losing their deposit if the robot fails.

For this reason, traders should decide the level of risk they are willing to take as well as how reliable their automated robots are.

Additional programs for forex trading

Despite the variety of EAs and their numerous advantages, they also have some drawbacks.

Among the main disadvantages, traders highlight that they become outdated rather quickly. Besides, sometimes they are inefficient as they cannot make intuitive decisions and apply fundamental analysis.

What is more, oftentimes, they are unavailable in mobile applications of trading platforms.

At first glance, it may not seem a disadvantage as the robot can operate independently without the interference of a trader. For this reason, there is no need to check it via a mobile app.

However, savvy traders do not recommend leaving the bots without oversight. In case of a force majeure, the robot will not be able to change the trading algorithm embedded in it.

It will continue to trade according to the set parameters in the changed market conditions. As a result, your positions will quickly become unprofitable.

That is why you need to monitor market changes by yourself as well as the work of the expert adviser in order to make the appropriate adjustments to its settings in time.

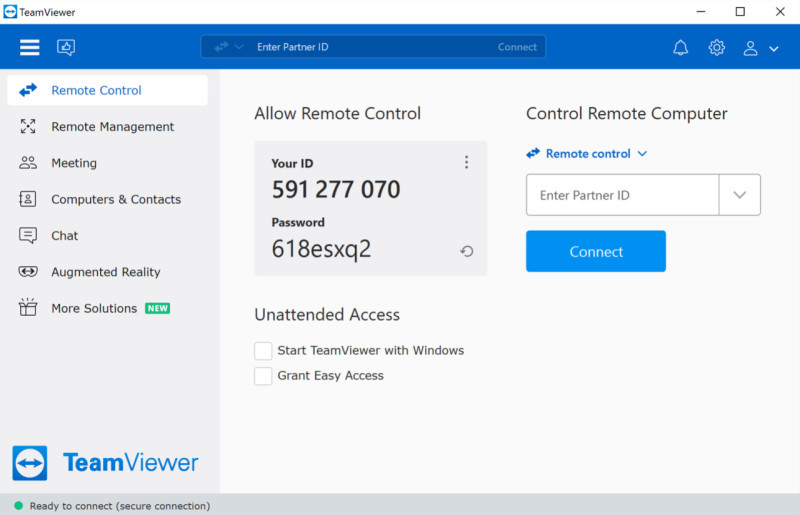

As it is impossible to do so by using a mobile application, traders have come up with another solution. They use remote control programs such as TeamViewer.

With the help of such programs, you can connect to your computer from any place and control bots using your smartphone or any other device.

Many traders also use special programs to test strategies and trading bots, as well as to analyze test results.

With the help of such popular and easy-to-use programs as Word and Excel, you can create notes with the results of trading for a day, a month, and so on.

Such notes help you analyze your own trading strategy or the efficiency of the robot. You can see what mistakes were made.

When the information is presented in a visual form, it is easier to perceive. There is no need to keep all the data in your head.

It is quite difficult to remember passwords from several accounts on different websites. There is also specially developed software for safe password storage.

Conclusion

In this article, we have explained to you how and where to start doing auto trading software. We also discussed how crucial it is to choose a trading platform and broker, as well as a trading strategy.

Only if you clearly understand how forex trading works and pick your own strategy, will you be able to choose or develop the most effective trading robot.

Trading robots are divided into two large categories: automated and semi-automated. Unlike semi-automated robots, automated robots can independently make transactions.

For your convenience, you can use special programs to remotely connect your phone to your PC, create notes, and store passwords.

Read more:

Automated trading on stock exchange: TOP robots and programs

Auto trading robot for Forex

Experience in automated trading on Forex and stock exchanges

Back to articles

Back to articles